REFERRAL PERKS®

For a limited time, earn $200* for you and your friend for every successful referral.

For a limited time, earn $200* for you and your friend for every successful referral.

Learn how an FHSA helps you save for your first home faster.

Learn which savings option is the best for your financial goals.

Explore this step-by-step complete guide to starting a business in British Columbia.

We’ve rounded up 10 of the most common scams — along with ways to identify and outsmart them.

We use cookies to personalize your browsing experience, save your preferences and analyze our traffic to improve features. By using our website you agree to our Cookie Policy.

When you’re in your 20s and 30s, retirement can feel like a thought that’s far, far away. We know what you’re thinking - it’s hard to plan for something nearly three or four decades in the future. Maybe you’re more focused on taking that summer trip or saving for a new car. Maybe you might even be saving up for a down payment on a home. You may even be struggling to pay off student debt. It’s tempting to think about retirement as an item for another day.

But here’s the thing: planning for retirement is exactly that – planning. Just like planning for a trip, car, house or anything else, there are things you can be doing right now to help set you up for success. Not to mention, there are a ton of tools and resources for achieving your short and long-term savings goals. Here’s what you can be doing in your 20s and 30s to begin planning your retirement. Whatever that looks like to you. Let’s start with a question.

Dreaming of living your best life on the beach during the winter and driving your grandkids around for ice cream during the summer? Perhaps you’re even thinking about paying for their education, while being a full-time philanthropist and community advocate. Whatever you envision, you’ll need the funds to support your lifestyle.

On average, retired Canadians are spending about $2,400 a month, or $28,800 a year. The average retirement age in Canada is just over 63 and a half years and the average life expectancy continues to rise. Right now, it’s at just over 81 years old. This means that you will need to build a retirement income plan to support you for about 20 to 30 years, or longer.

If your plan is to retire early, or even have more spending money, you can use this retirement planning calculator to set your own personalized amounts. Want to retire at 40 and spend $5,000 per month?

You’ll need $2.46M. Or, to retire at 50 and spend $4,000 per month, you’ll need just over $1.48M. Another lofty goal, eh? It doesn’t have to be. Plan it out.

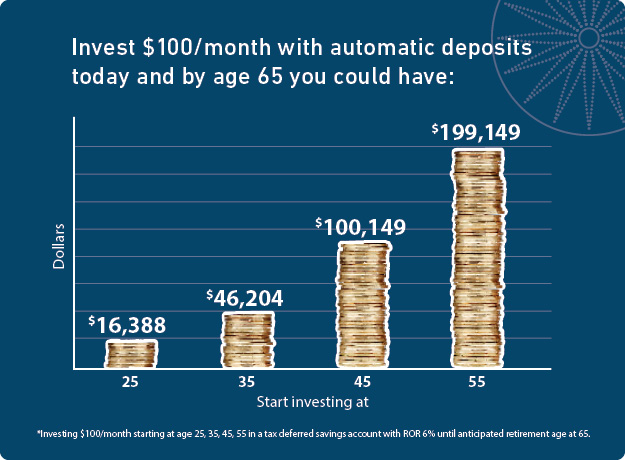

What you do now in your 20s and 30s will help set you up for your 60s and 70s, and longer. The younger you are, the more time you have for your money to grow.

Wherever you can, try your best to set and hit a savings goal, start a registered savings plan, gain compound interest with term deposits, and take advantage of benefits from your employer like group plans. All these incremental steps will pay large returns in the future if you start small now.

Also, do your best to manage debt. Estimate what you owe today on your loans, credit cards and lines of credit. Are you paying each of these items on time? If not, you’ll be paying interest which takes you further away from saving money.

In addition to building savings, you’ll want to understand your credit score and start building up a positive credit history so that when the time comes and you want to take a large loan, such as a mortgage, you'll be able to show them you can reliably repay your debts. A house is a big asset to work towards. It can ultimately become the biggest part of your investment portfolio, which you can leverage later on down the road.

The general rule of thumb is to save 10 per cent of your income. This can be tricky, especially early in your 20s and 30s. If you can't save this much, save what you can and adjust as you progress. You won't miss what you're putting away if you have included in in your budget. If you can find a way to put savings away, do it. And this doesn’t necessarily mean getting a side-hustle.

Think about what you need and what you don’t need. Audit your spending. Review your credit card and MemberCard debit card statements. You’ll be surprised what you find. Gym memberships and classes you haven’t been taking, big cell phone bills with data overages, expensive hand soaps, lots of brunch and wine bills. When you add it all up, you’ll be surprised at the total. If you were able to cut down or even eliminate these expenses, you could pocket that money and put it towards your savings. Talk to an advisor about creating a budget that works for you.

Savings doesn’t have to be all about cutting spending. You can save with programs, while you spend. Take advantage of programs like BIGChange®, which rounds up your MemberCard debit card purchases and deposits the difference in your high interest savings account.

Throughout your career, you’ll likely have opportunities to opt into a group RRSP – do it! Typically, your employer offers a matching contribution, so you’ll get an automatic return on investment. On average companies offer to match anywhere between 3-6%.

So, let’s say your paycheque comes. You automatically enroll to have 6% of your pay go towards your registered plan. Your employer matches that, for free, so now you have 12% going towards saving for retirement. If you make an average of $55,000 per year, 12% of this is $6,600 per year. If you keep the same level of contribution for the next 30 years that’s $198,000 that you will have saved with an RRSP alone. And, the best part is half of that money was free from your employer as part of group RRSP matching.

Not all group RRSPs are the same, and not all employers offer a group RRSP. If you aren’t offered one at work, you can open an RRSP yourself. Your annual contributions are tax deductible and can reduce the amount of income tax you pay. It’s the government’s way of incentivizing you to save. And, you can borrow up to $60,000 from your RRSP to be used for a down payment on a home. Even better news, you can combine it with your FHSA to borrow a total of 100k.

You can also open a Tax-Free Savings Account (TFSA), where withdrawals are non-taxable and can be made at any time without restrictions.

Once you’ve mastered the art of saving – start investing early. There are lots of people who don’t retire with $1 million saved. Investing can help offset whatever you can’t save yourself, or it can help you build as you get there. Your cash, registered plans and home can all be part of your investment portfolio – and that's not including the growth of the portfolio either. You can also make money with your savings through mutual funds, stocks and bonds.

Responsible investing allows you to invest in organizations committed to making a positive impact to our society and environment by offering investment strategies that incorporate environmental, social, and governance (ESG) screening criteria into the selection and management of investment. It allows you to exclude investing into companies that are involved with activities around tobacco, weapons, gambling, while including companies that, through their services or company values, engage in environmental sustainability, social justice and diversity and inclusion practices.

There are going to be lots of early mornings and cups of coffee that go into those hard-earned dollars. As a credit union, we value your hustle and your stick-to-itiveness towards savings.

We all have different dreams for life after work, which is why it’s important to figure out your own vision for retirement. Let our team stand by you and help you plan your financial future.

We like to ensure that you have the tools and resources you need to budget and save. Here are some other helpful articles to lean on for insight:

Planning for the future?

Let us help. Our advisors will work with you to help you reach your goals with a personalized plan.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc.

We acknowledge that we have the privilege of doing business on the traditional territory of First Nations communities.

© First West Credit Union. All rights reserved.

Proudly Canadian