REFERRAL PERKS®

For a limited time, earn $200* for you and your friend for every successful referral.

For a limited time, earn $200* for you and your friend for every successful referral.

Learn how an FHSA helps you save for your first home faster.

Learn which savings option is the best for your financial goals.

Explore this step-by-step complete guide to starting a business in British Columbia.

We’ve rounded up 10 of the most common scams — along with ways to identify and outsmart them.

One of the foundations of financial wellness is having a healthy credit score. A significant part of achieving this is understanding your credit score, what it means, how it’s calculated and learning practical strategies to improve it.

There are simple steps you can take to improve their credit score. But before we explore some of those strategies, we’re going to look at what makes a good score, how it’s calculated, where you can check yours, and why it all matters.

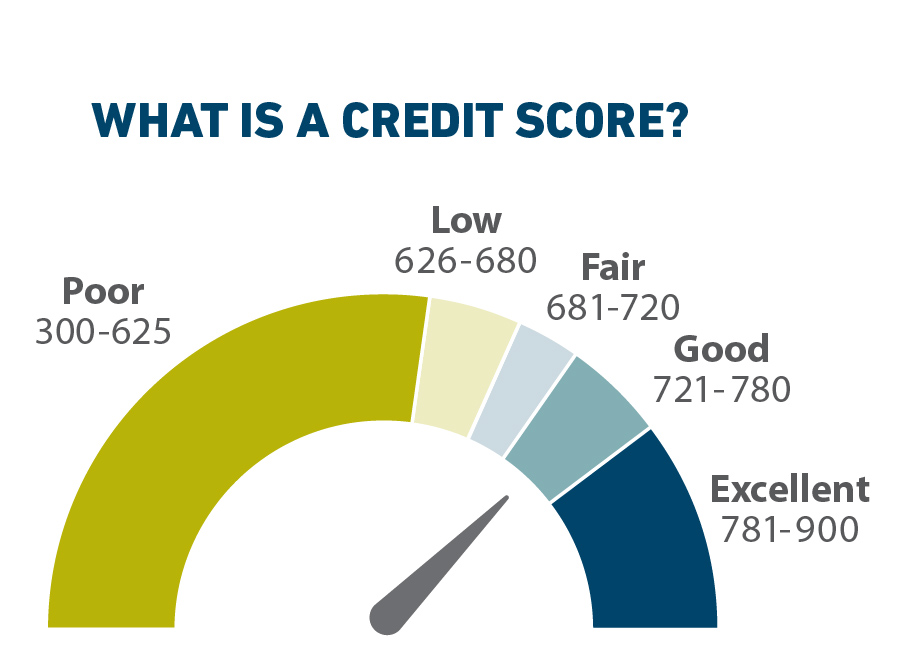

In Canada, credit scores range from 300 to 900, 900 being a perfect score and 300 the lowest.

According to data from a 2022 survey, the average credit score in Canada is 672, and 694 in British Columbia.

Your credit score is used by lenders to determine what kind of borrower you are. It can affect your eligibility for certain loans or credit cards, as well as the interest rate you get.

You may know some of the fundamentals already, such as debt utilization ratio and the difference between hard checks and soft checks or between revolving credit and installment credit. But these are just a small part of the story when it comes to seeing the full picture of your overall credit.

A low credit score doesn’t automatically mean you’ll never be able to borrow. Some places might still lend you money, but it could be at a higher interest rate.

This is one of the ways you’ll find your credit score really matters: the better your score, the less you pay through interest. In other words, a good credit score helps you save money.

A low credit score doesn’t automatically mean you’ll never be able to borrow. Some places might still lend you money, but it could be at a higher interest rate.

This is one of the ways you’ll find your credit score really matters: the better your score, the less you pay through interest. In other words, a good credit score helps you save money.

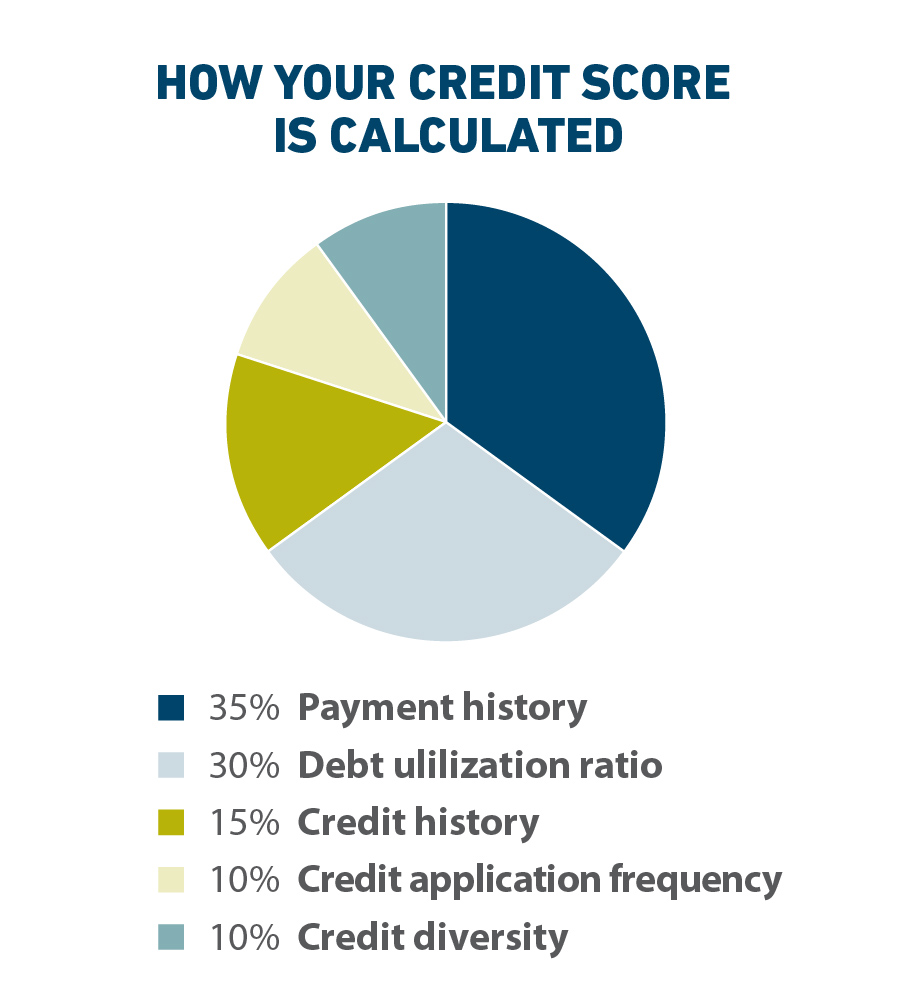

Your credit score is calculated using these five factors. Most of the information is automatically removed after 6 to 7 years, although not purged.

So good news: That phone bill or student loan payment you missed a while back won’t be haunting your score today!

Payment history is the most important factor affecting your credit score. Prospective creditors want to know that you are going to pay them back. Your payment history covers all consumer debt, including credit cards, lines of credit, student loans, car loans, and cell phone payments on contract.

CREDITORS WANT TO KNOW

When creditors look at how much you owe, they’re trying to determine if you can take on more debt, and if you can manage with more.

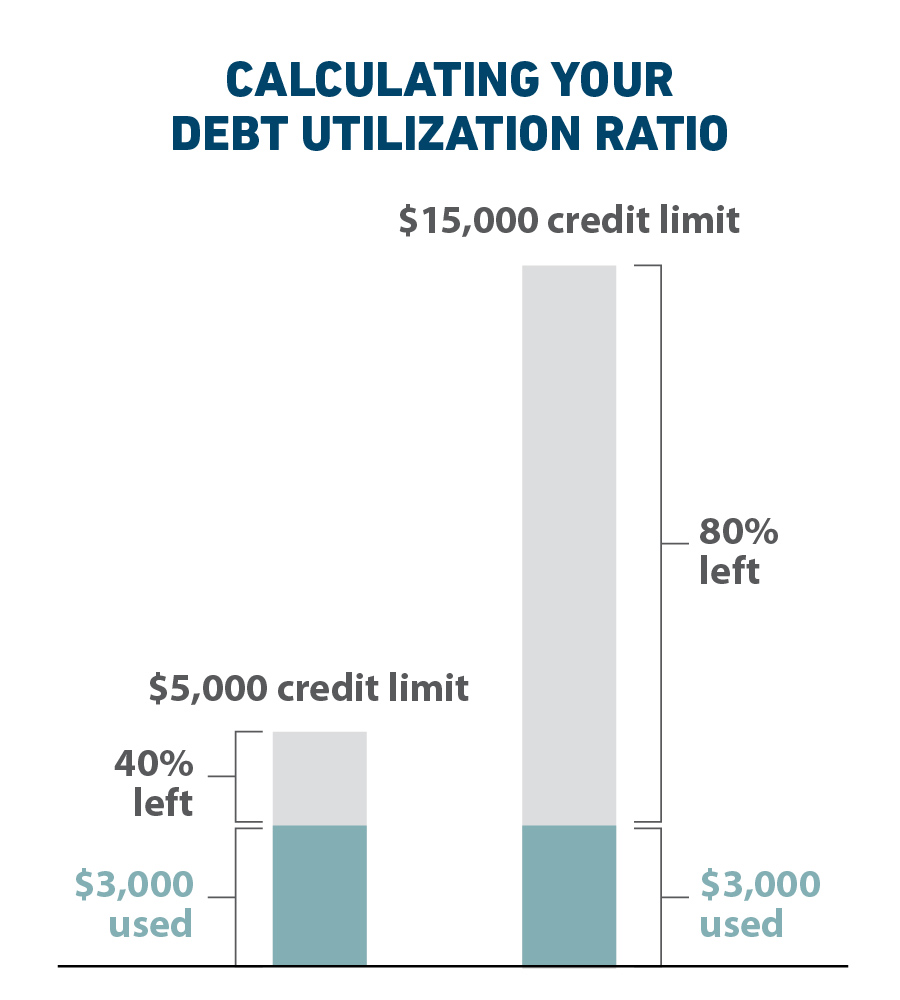

Besides looking at the amount of debt that you currently have, lenders will look at what’s called debt utilization ratio: that’s the amount of credit you’re using compared to the amount that’s available to you.

For example, if you have a credit card limit of $5,000 and you’re constantly hovering at $3,000, then you’re using 60% your available credit on an ongoing basis. To a creditor, that indicates that you’re struggling to pay off your existing debt. Meanwhile, if you have a $15,000 credit limit, $3,000 used only makes up 20% of your credit.

Creditors will also look at how much outstanding debt you have compared to how much was available to you.

When creditors look at how much you owe, they’re trying to determine if you can take on more debt, and if you can manage with more.

Besides looking at the amount of debt that you currently have, lenders will look at what’s called debt utilization ratio: that’s the amount of credit you’re using compared to the amount that’s available to you.

For example, if you have a credit card limit of $5,000 and you’re constantly hovering at $3,000, then you’re using 60% your available credit on an ongoing basis. To a creditor, that indicates that you’re struggling to pay off your existing debt. Meanwhile, if you have a $15,000 credit limit, $3,000 used only makes up 20% of your credit.

Creditors will also look at how much outstanding debt you have compared to how much was available to you.

CREDITORS WANT TO KNOW

Creditors want to see a long-established history of managing credit. There’s nothing more frightening to them than somebody walking out of the woods with a clean slate. A good credit history is built over time and that’s something you can’t lifehack.

CREDITORS WANT TO KNOW

Creditors see frequently applying for credit as a red flag that tends to signal financial difficulty rather than stability. If you sign up for new credit cards, loans or other forms of credit often, lenders may conclude that you're not able to manage your money.

There are two kinds of credit checks: hard checks and soft checks.

CREDITORS WANT TO KNOW

There are two kinds of credit: revolving credit and installment credit.

Having high levels of revolving credit is not the same as having equal levels of installment credit. The latter is considered more secure.

CREDITORS WANT TO KNOW

Now you know what a credit score is and how it’s calculated, but how do you actually check it?

In Canada, your credit score is calculated by two different credit bureaus: Equifax and TransUnion. You can request a free copy of your credit report by mail at any time, though your credit score is not included on the reports. Both bureaus can provide your credit score for a fee and offer credit monitoring services.

If you prefer an instant look at your credit score, there are several apps that share that information with you monthly, including Borrowell, Credit Karma, and CreditVerify.

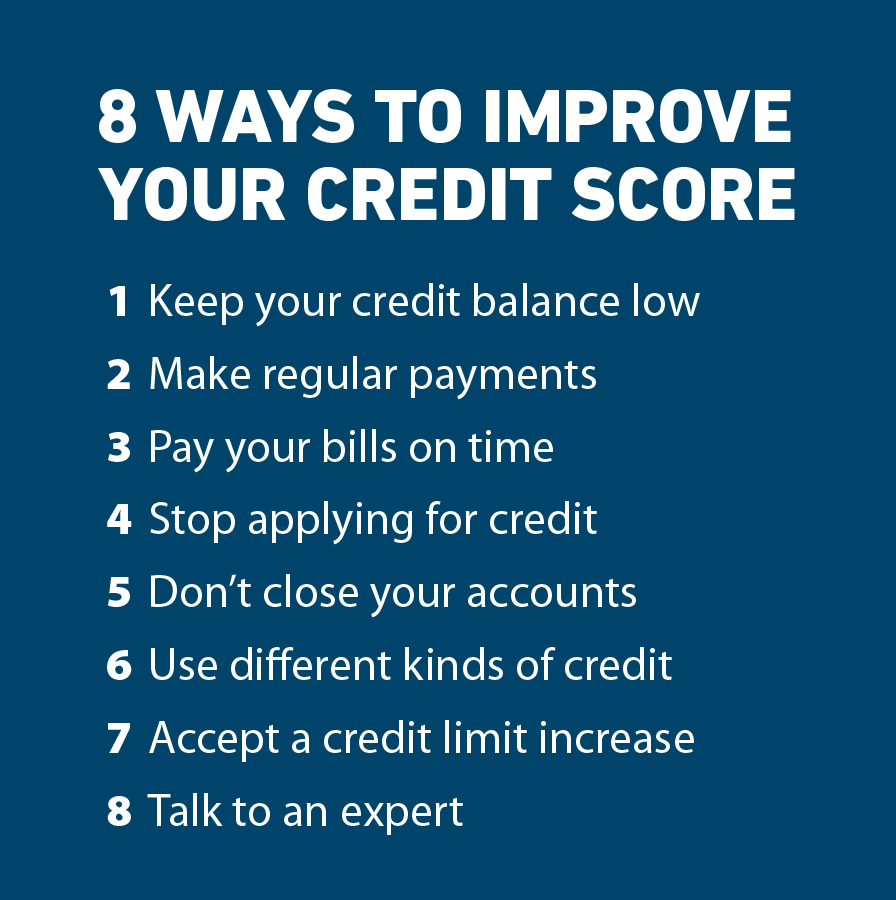

When you understand how your credit score is calculated, it’s easier to see how you can improve it. That’s the good news: no matter how low your score is, there are a few relatively easy ways that you can change your habits and improve it.

One of the easiest ways to improve your credit score or to build it from the ground up is to make consistent, regular payments on time over time. These are things that potential lenders love to see, like consistency, dependability, regularity, and history.

When it comes to credit cards, the best financial advice is always to pay it off once or twice per month so you’re never running a balance. Making regular payments is one of the best habits to get into because you’re always paying down your debt.

Remember when we discussed how your payment history is the biggest part of your credit score calculation? If you have several credit cards and you’re thinking about closing one (or several) of them to help you manage your debt a little better, it’s more advantageous for your credit score to close the most recent one. That way, you can maintain the history with an older account.

You may have some good reasons to close your older accounts, such as a higher interest rate, annual fee, and so forth. If that’s the case, consider your timing. Your purchase of a new car in a couple months, new cell phone contract or application for a line of credit will go smoother if your credit looks as good as possible.

Be aware: Canceling a credit card will always have an immediate negative impact on your credit score, because you are reducing the amount of available credit and usually increasing your debt utilization ratio. It’s easier to pay off the card and set it aside to not use anymore instead of closing it altogether.

Improving your debt utilization ratio is one of the fastest ways to build up your credit; you could even see your score go up 30 to 50 points in a month! The ideal debt utilization ratio is 30%, but it’s best to keep it below 10%.

The best way to do that is, of course, to pay down the balance, but you can also accept offers to increase your credit limit. Be careful, though: If you call in to ask for your credit limit to be increased, you’ll initiate a hard check, and that will hit your credit score.

But when your credit card company sends an offer to increase your limit, and the time is right, look into it. Just be mindful that you're not going into more debt to improve your credit score.

Which do you think a lender would rather see on your credit report: a credit card, or a student loan? A line of credit, or an RRSP loan?

Creditors see revolving credit as less secure than installment credit. If improving your credit score is your goal, then you want to diversify your sources.

It doesn’t have to be a lot. A small loan that you pay off within 12 months will go a long way. Just think outside of the credit card box, or consider a secured credit card.

Everything is easier with a little help.

We acknowledge that we have the privilege of doing business on the traditional territory of First Nations communities.

© First West Credit Union. All rights reserved.

Proudly Canadian