REFERRAL PERKS®

For a limited time, earn $200* for you and your friend for every successful referral.

For a limited time, earn $200* for you and your friend for every successful referral.

Learn how an FHSA helps you save for your first home faster.

Learn which savings option is the best for your financial goals.

Explore this step-by-step complete guide to starting a business in British Columbia.

We’ve rounded up 10 of the most common scams — along with ways to identify and outsmart them.

A market-linked term deposit with a guaranteed minimum return and the potential to earn more.

![]() Principal investment protected

Principal investment protected

![]() Guaranteed minimum return

Guaranteed minimum return

![]() Higher return potential than traditional term deposits/GICs

Higher return potential than traditional term deposits/GICs

If you already bank with us, book an appointment to open with an advisor. And if you're new to us, become a member in only a few minutes.

Or call us at 1-888-597-1083.

![]() Principal investment protected

Principal investment protected![]() Guaranteed minimum return

Guaranteed minimum return![]() Higher return potential than traditional term deposits/GICs

Higher return potential than traditional term deposits/GICs

If you already bank with us, book an appointment to open with an advisor. And if you're new to us, become a member in only a few minutes.

Or call us at 1-888-597-1083.

Is this investment account right for you?

Right for you if:

Might not be right for you if:

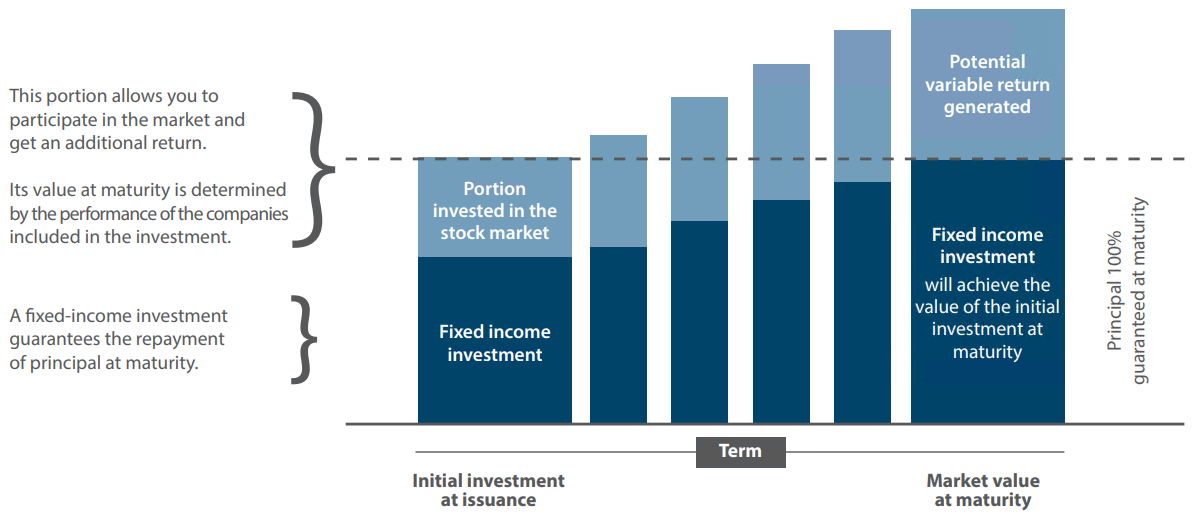

winwin® market-linked GICs are made up of two complementary components combined to offer you the best of both worlds:

| winwin® FINANCIAL SERVICES market-linked GIC (registered/non-registered/business)

Rates Effective: 2025-05-20 |

Rate |

|---|---|

| Minimum guaranteed annual rate (3 year) |

0.50

|

| Maximum potential cumulative return (3 year) |

24.00

|

| Minimum guaranteed annual rate (5 year) |

0.50

|

| Maximum potential cumulative return (5 year) |

40.00

|

3-year term deposits purchased within the above promotion period will be issued August 18, 2025 (issue date) and will mature on August 18, 2028 (maturity date). 5-year term deposits purchased within the above promotion period will be issued August 19, 2025 (issue date) and will mature on August 19, 2030 (maturity date).

Benefit from the growth potential of eight carefully selected major Canadian financial and insurance institutions with limited exposure to market downsides.

Market-linked GICs are a sort of hybrid investment vehicle: part GIC, part stock market investment. They protect the investor’s principal investment and offer a minimum guaranteed return with the potential for significantly greater returns (up to a maximum) based on the performance of the market. Think of it as having a stable floor, and potentially a high ceiling. Market-linked GICs usually have a theme to them, such as focusing on an industry, exclusively national, international, emerging-market stocks, or more recently, responsible investing.

Unlike a traditional GIC, a market-linked GIC is tied to a particular stock market index - like financial, healthcare or insurance services - which gives the investor an opportunity to benefit from market gains to a limited maximum.

The basket of securities is linked to 8 equally weighted major Canadian financial & insurance institutions.

| COMPANY | STOCK MARKET |

|---|---|

| Bank of Montreal | Toronto |

| Bank of Nova Scotia | Toronto |

| Canadian Imperial Bank of Commerce | Toronto |

| Intact Financial Corporation | Toronto |

| Manulife Financial Corporation | Toronto |

| National Bank of Canada | Toronto |

| Royal Bank of Canada | Toronto |

| Sun Life Financial Inc. | Toronto |

Historical returns provided are for informational purposes, past performance is not indicative of future returns.

| 3-year Terms |

|||

|---|---|---|---|

| issue date / maturity date |

minimum guaranteed annual rate | maximum potential cumulative return | actual return received by member |

| June 7, 2022 / June 10, 2025 | 0.60% | 12.00% | 12.00% |

| April 1, 2022 / April 1, 2025 | 0.50% | 12.00% | 12.00% |

| Feb 2, 2022 / Feb 3, 2025 | 0.50% | 12.00% | 12.00% |

| Dec 1, 2021 / Dec 2, 2024 | 0.10% | 10.00% | 10.00% |

| Oct 4, 2021 / Oct 4, 2024 | 0.10% | 10.00% | 10.00% |

| Aug 4, 2021 / Aug 6, 2024 | 0.10% | 7.00% | 7.00% |

| 5- year Terms |

|||

|---|---|---|---|

| issue date / maturity date |

minimum guaranteed annual rate | maximum potential cumulative return | actual return received by member |

| June 4, 2020 / June 4, 2025 | 0.80% | 25.00% | 25.00% |

| April 3, 2020 / April 3, 2025 | 0.80% | 25.00% | 25.00% |

| Feb 7, 2020 / Feb 7, 2025 | 0.80% | 25.00% | 25.00% |

| Dec 4, 2019 / Dec 4, 2024 | 0.80% | 25.00% | 25.00% |

| Oct 4, 2019 / Oct 4,2024 | 0.80% | 25.00% | 25.00% |

| Aug 9, 2019 / Aug 9, 2024 | 0.80% | 20.00% | 20.00% |

You could experience a higher than usual interest rate payment on the maturity date of a winwin® term depending on the final index performance. In the final year, the interest rate paid would be the difference between the final rate of return minus the minimum rate already paid. Please seek independent tax advice as required for your unique financial situation.

Not sure which investment is right for you?

We can help. Visit a branch or call us at 1-888-597-1083, and let's find the right solution together.

From November 1, 2021, to November 21, 2021, the members of First West Credit Union voted on special resolutions that, among other things, authorize First West to apply to become a federal credit union under the Bank Act. If First West becomes a federal credit union, it will automatically become a member of the Canada Deposit Insurance Corporation (CDIC) and Credit Union Deposit Insurance Corporation of British Columbia deposit insurance will no longer apply. See attached Notice for further detail on what this change means to your deposits with First West.

® Registered trademark of First West Credit Union

Terms and conditions:

*Rates as of the start date communicated in the disclosed promotion period.

The minimum guaranteed annual interest rate is paid out annually and does not compound. This product has a ceiling that determines the maximum return that you may receive at maturity. Terms and conditions apply.

The return of a winwin® term deposit depends on the performance of the index return that it is linked to over a certain time period, the Minimum Guaranteed Return and the Maximum Potential Cumulative Return.

Good advice starts with a conversation about your unique situation. We’ll work with you to understand your overall investment strategy and make recommendations on the right mix of investment solutions for your financial goals.

Let’s talk about your financial wellbeing.

We acknowledge that we have the privilege of doing business on the traditional and unceded territory of First Nations communities.

© First West Credit Union. All rights reserved.

Proudly Canadian