Part of achieving financial wellness is understanding your credit score, what it means, how it’s calculated and learning practical strategies to improve it.

Understanding debt utilization ratio and the difference between hard checks and soft checks or between revolving credit and installment credit are just a small part of the story when it comes to seeing the full picture of your credit.

There are simple steps people can take to improve their credit score but before we explore some of those strategies, we’re going to look at what makes a good score, how it’s calculated, where you can check yours, and why it all matters.

What is a good credit score in Canada?

Your credit score is used by lenders to determine what kind of borrower you are. It can affect your eligibility for certain loans or credit cards as well as the interest rate you get.

In Canada, your credit score ranges from 300 to 900, 900 being a perfect score. If you have a score between 780 and 900, that’s excellent. If your score is between 700 and 780, that’s considered a strong score and you shouldn’t have too much trouble getting approved with a great rate. When you start hitting 625 and below, your score is getting low and you’ll start finding it more and more difficult to qualify for a loan.

What does a low credit score mean?

A low credit score doesn’t mean you’ll never be able to borrow. Some places might still lend you money, although at a higher interest rate. This is one of the ways you’ll find your credit score really matters: the better your score, the less you pay on interest.

In other words, a good credit score helps you save money.

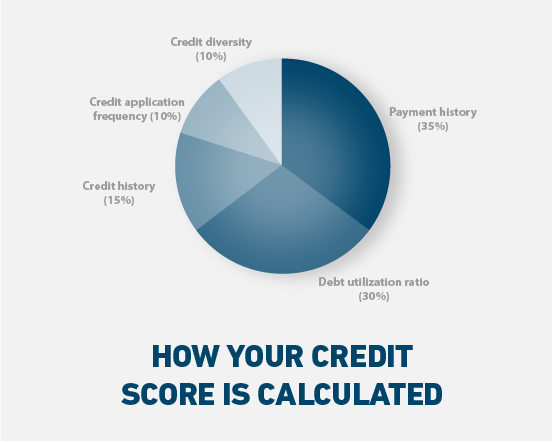

How is your credit score calculated?

Your credit score is calculated using five factors:

- Payment history (35%)

- Debt utilization ratio (30%)

- Credit history (15%)

- Credit application frequency (10%)

- Credit diversity (10%)

Most of the information is automatically removed after 6-7 years (although not purged) so that student loan payment you missed 20 years ago won’t be haunting your score today.

1. What’s your payment history?

This is obviously the most important factor affecting your credit score. Prospective creditors want to know that you are going to pay them back. Your payment history covers all of your consumer debt: credit cards, lines of credit, student loans, car loans, cell phone payments on contract, etc.

CREDITORS WANT TO KNOW

- Do you pay your bills on time?

- How frequently do you miss a payment?

- How many times have you missed a payment?

- How old are your missed payments?

2. How much do you currently owe?

When creditors look at how much you owe, they’re trying to determine whether or not you are able to take on more debt. Can you manage with more?

Besides looking at the amount of debt that you currently have, lenders will look at what’s called debt utilization ratio: that’s the amount of credit you’re using compared to the amount that’s available to you.

For example, if you have a credit card limit of $5,000 and you’re constantly hovering at $3,600, then you’re using 75% your available credit on an ongoing basis. To a creditor, that indicates that you’re struggling to pay off your existing debt.

Creditors will also look at how much outstanding debt you have compared to how much was available to you.

CREDITORS WANT TO KNOW

- How much in total do you currently owe?

- How much are your payments?

- How much of your available credit do you use on an ongoing basis?

3. How long is your credit history?

Creditors want to see a long established history of managing credit. There’s nothing more frightening to them than somebody walking out of the woods with a clean slate. A good credit history is built over time and that’s something you can’t lifehack.

CREDITORS WANT TO KNOW

- How long has it been since you first obtained credit?

- How long you’ve had each account for?

- Are you actively using credit now?

4. How frequently are you applying for new sources of credit?

Frequently applying for credit is a flag for creditors. It tends to signal financial difficulty rather than stability. If you frequently sign up for new credit cards, loans or other forms of credit, lenders may conclude that you're not able to manage your money.

There are two kinds of credit checks: hard checks and soft checks.

Soft checks are when you or a third party are reviewing your credit for non-lending purposes (eg. prospective employer, etc.). Soft checks don’t affect your credit score.

A hard check happens when you’re looking for credit. If you’re applying for a new loan, a new credit card, looking to finance your new computer, negotiating your new cell phone plan...the lender will check your credit by initiating a hard check. Hard checks hurt your credit rating.

CREDITORS WANT TO KNOW

- How many times did you request a hard credit check in the last 5 years?

- How many credit accounts have you opened recently?

- How much time has passed since you last opened a new account?

- How long ago was your most recent inquiry?

5. What kind of credit have you used?

The kinds of credit you use can say a lot about how you handle your finances. There are two kinds of credit: revolving credit and installment credit.

Installment credit comes in the form of a loan that you pay back regularly (once a month, bi-weekly, whatever it may be). The amount of the loan is set when you are approved and the sum that you borrow doesn’t change.

Revolving credit on the other hand is not a predetermined amount. You will have a credit limit that sets how much you can borrow up to, but you can pay it off and spend it again indefinitely.

Having high levels of revolving credit is not the same as having equal levels of installment credit. The latter is considered more secure.

CREDITORS WANT TO KNOW

- Do you have high levels of revolving credit?

- Do you use deferred interest or payment plans to pay for large purchases?

- Do you resort to loan consolidation services?

- Do you access payday loans or other unsecured loans?

How do you check your credit score in Canada?

Nearly half of Canadians (47%) don’t know where to check their credit scores.

In Canada, your credit score is calculated by two different credit bureaus: Equifax and TransUnion. You can request a free copy of your credit report by mail at any time though your credit score is not included on the reports.

Both of these bureaus can provide you with your credit score for a fee, and also offer credit monitoring services. For more information visit TransUnion or Equifax.

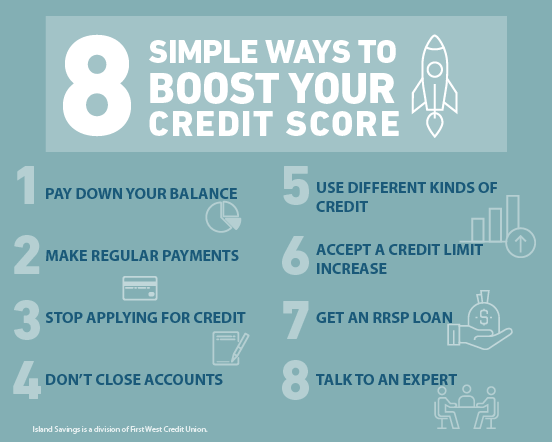

How do you improve your credit score?

When you understand how your credit score is calculated, it’s easier to see how you can improve it. That’s the good news: no matter how bruised your score is, there are a few relatively easy ways that you can change your behaviours and improve it.

1. Make regular payments

One of the easiest ways to improve your credit score or to build it from the ground up is to make consistent, regular payments on time over time. These are things that potential lenders love to see: consistency, dependability, regularity and history.

When it comes to credit cards, the best financial advice is always to pay it off every month (or twice a month) so you’re never running a balance. Making regular payments is one of the best habits to get into because you’re always paying down your debt.

2. Close your newer accounts

If you have several credit cards and you’re thinking about closing one (or several) of them to help you manage your debt a little better, it’s more advantageous for your credit score to close the most recent one. That way you can maintain the history with an older account.

There may be better reasons to close your older accounts (higher interest rate, annual fee, etc.) in which case just consider your timing: if you know you’re going to buy a new car in a couple months or get a new cell phone contract or a line of credit, wait to close that older account so you can go in with your credit looking as good as possible.

However you do it though, just be aware that canceling a credit card will always have an immediate negative impact on your credit score because you are reducing the amount of available credit and usually increasing your debt utilization ratio.

3. Accept an increase on your credit limit

Improving your debt utilization ratio is one of the fastest ways to build up your credit and you could see your score go up 30-50 points within 30 days. The ideal debt utilization ratio is 30%, but it’s best to keep it below 10%. The best way to do that is obviously to pay down the balance. You can also accept offers to increase your credit limit.

If you’re calling in to ask for your credit limit to be increased, that’s a little bit different as you’ll initiate a hard credit check and that will hit your credit score. But credit card companies will often offer their customers an increased limit, so wait for your phone to start ringing.

Just be careful you're not getting into more debt in an attempt to improve your credit score.

4. Use different kinds of credit when possible

Remember that revolving credit is considered to be less secure than installment credit.

Which do you think a lender would rather see on your credit report: a credit card or a student loan? A line of credit or an RRSP loan?

If improving your credit score is your goal then you want to diversify your sources. It doesn’t have to be a lot. A small loan that you pay off within 12 months will go a long way. Just think outside of the credit card box (or consider a secured credit card).

Especially if you are just starting out with no credit, an RRSP loan is one of the best tools at your disposal. It’s a big win as it helps you build a great credit history (through installment credit) while boosting your RRSP savings (and benefitting from the tax benefits that come along with it).

Why your credit score matters

When you understand your credit score, how it’s calculated and how you can improve it, you start to think a little more deeply about the debt you might be considering. Not only that, but working to improve your credit score develops strong financial habits. It's building a foundation will help you as you continue your journey towards financial well-being.

When it comes to credit, the most important rule is this: don’t bite off more than you can chew. If you're worried about taking on more debt — or if you're aware that you struggle to pay down your credit cards and you're concerned a higher credit limit might be more harmful than beneficial — these are valuable flags to pay attention to.

If you are struggling with debt and are concerned that your only options to dig your way out seem to be to take on more debt, talk to an expert. We are here to help you find the best option available to you and give you peace of mind.

We want to help you make the best decision for you and your family and to make a plan to become debt-free.