BORROWING SOLUTIONS TO GROW YOUR BUSINESS

We have financing options to help your business reach its full potential.

CHOOSE FROM THESE BORROWING OPTIONS

Business Mortgage

Finance a new home for your business or buy/develop other commercial property.

Business Loans

Finance large purchases for your business with a fixed or variable rate loan.

Operating Line of Credit

Get access to extra operating funds to cover short-term gaps in cash flow.

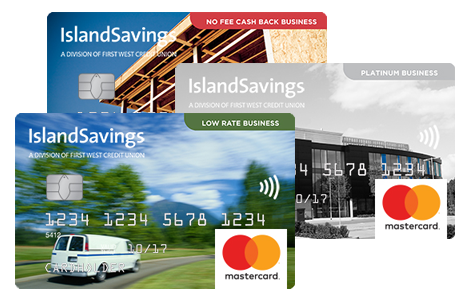

A CREDIT CARD FOR YOUR BUSINESS

Whether you're looking to collect points, reward yourself with cash or take advantage of a low interest rate, you'll find a card that's just right for you.