Going to university costs a lot of money. That should come as no surprise. And the way things are looking now, the rising costs of living are only going to increase tuition costs.

What that means is for a large demographic, the dreams of your children receiving a post-secondary education are getting more and more out of reach. Watching your children trying to claw their way out of debt is hard for any parent.

An RESP can help reduce that future burden, or even get rid of it entirely.

What’s an RESP?

RESP stands for Registered Education Savings Plan. It’s an investment account where the savings for your child’s education grow tax-free. There are two other benefits RESPs have that really make them worthwhile: free government money and the power of compounding interest.

We’ll be walking through both of these so you can understand exactly what the big deal is with RESPs.

Key terms

Here is a glossary of common terms you’ll find when dealing with RESPs.

- Subscriber: the subscriber is the individual who opens an RESP account, entering into a contract with a promoter and naming one or several beneficiaries on whose behalf the contributions are made. For individual plans, there are no restrictions on who can be a subscriber.

- Beneficiary: the beneficiary of an RESP is the person (usually the child of the subscriber, but not necessarily) who will benefit from the contributions made in the RESP.

- Promoter: is the institution or company that sets up the RESP and pays the contributions as well as the income earned on the contributions to the beneficiaries.

- Contributions: the funds the subscriber (or subscribers) deposits into a RESP. Unlike with RRSPs, these contributions are not tax-deductible. However, this does mean that you can withdraw them at any time without having to pay additional income tax.

- Educational Assistance Payments (EAP): EAPs are funds beneficiaries can withdraw from an RESP account to pay for their post-secondary education. They include the earnings (interest and other income) accumulated in an RESP as well as government grants but do not include the subscriber’s contributions. When withdrawn, they count as taxable income for the beneficiary.

- Refund of Contributions (ROC): An ROC is a withdrawal of the contributions. Because contributions were made from a subscriber’s after-tax income, an ROC has no additional tax penalty.

- Accumulated Income Payments (AIP): AIPs are withdrawals of the income earned on an RESP available if the beneficiary does not attend post-secondary education. It does not include any government grants, which are returned to the government. AIPs become taxable income once withdrawn. If you have unused contribution, you can reduce the amount of tax you pay by transferring your AIP directly to your RRSP.

- Canada Education Savings Grant (CESG): the CESG is a federal grant that matches a percentage of the subscriber’s contributions to an RESP up to $7,200.

- British Columbia Training and Education Savings Grant (BCTESG): the BCTESG is a provincial incentive that provides a one-time grant of $1,200 towards an RESP for residents of BC born in 2006 or later. The BCTESG is available on the child’s sixth birthday.

- Canada Learning Bond (CLB): the CLB is a federal government grant to help income-qualified families save for their children’s post-secondary education.

Highlights of an RESP

Maximum RESP contribution

A lifetime limit of $50,000 per beneficiary can be contributed to an RESP, which can be kept open for up to 36 years.

RESP tax implications

Interest earned on an RESP is tax-free. When the plan’s beneficiary starts withdrawing the money for school, only the accumulated interest is taxable as income.

Who contribute to an RESP?

Anyone can contribute to an RESP, not just the parents of the child, so you can open or contribute to the RESP of a grandchild, niece, nephew, godson, goddaughter, neighbour’s kid, etc. You can even open an RESP for yourself.

Family plan vs. individual plan

Family plans can have multiple beneficiaries all of whom must be related to the subscriber and allow the flexibility to name one or more children as beneficiaries, and add or change beneficiaries at any time. If one of the beneficiaries decides not to attend a post-secondary institution, other beneficiaries can make use of the funds.

Individual plans have a single beneficiary only who may or may not be related to you. An individual plan is also ideal for one-child families, or for those who require individual plans for each child (for example in a situation of blended families.) The beneficiary named in an individual plan could be replaced by another—subject to restrictions.

RESP government match

There are three government grants related to RESPs that BC residents can apply for:

- the British Columbia Training and Education Savings Grant (BCTESG): offered by the BC government as of August 2015, it provides a one-time grant of $1,200 towards an RESP for residents of BC born in 2006 or later, available on the child’s sixth birthday.

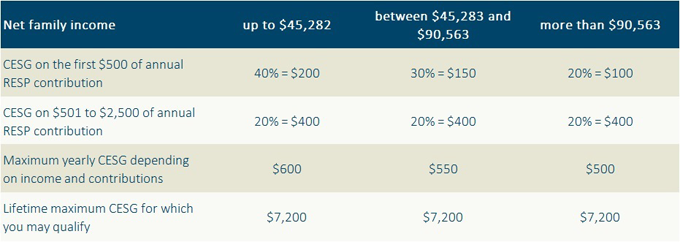

- the Canada Education Savings Grant (CESG): offered by the federal government, this grant matches 20% of a subscriber’s contribution to an RESP up to $500 annually (or $1,000 if there is carry-forward from previous years) and a total of $7,200.

- the Canada Learning Bond (CLB): money that the Government of Canada deposits into the RESP of income-qualified families to help save for their child’s post-secondary education.

Since the BCESTG is a one-time contribution and relatively straightforward and the CLB is for income-qualified families only, we’ll be focusing on the federal grant.

How much should I contribute to an RESP?

The CESG will match 20% of your contributions up to $500 a year. That is a steal of a deal: where else do you get a guaranteed 20% rate of return?

Actually it’s even better than that, as the contributions vary depending on your income bracket. 20% is the maximum match. If your family net income is below $90,563, the CESG will match 30-40% on the first $500 you deposit in your RESP every year, then 20% on the next $501-$2,500. See the table below.

Option A: get the full match every year

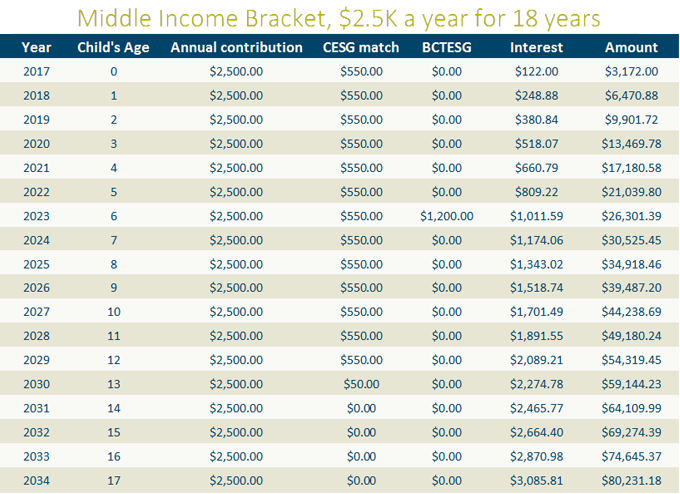

In order to get the full annual government match, you’d have to put in $2,500 every year (which comes to about $209 a month).

However, the maximum lifetime contribution for the CESG is $7,200, so at that rate you’ll get the full match in:

- 12 years if you’re in the lowest income bracket

- 13 years if you’re in the middle bracket

- 14 years if you’re in the higher bracket

That means that if you started contributing to your child’s RESP at their birth, you’ll have an extra three to five years of unmatched contributions. Which is fine, especially if you can afford that monthly payment (we’ll show you in a bit just how advantageous this would be in the long run).

But if what you are looking for is to make the most of the government’s match while paying as little as possible (because let’s face it, life—aka daycare—isn’t cheap these days), then here’s another way you could strategize your RESP contributions and not break the bank.

Option B: get the full lifetime match

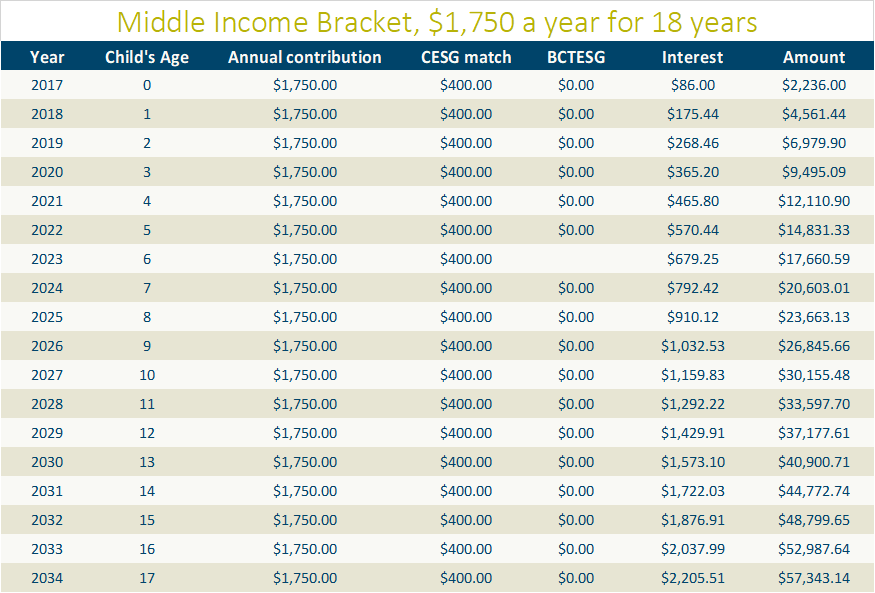

The CESG match is available until the calendar year when your child turns 17. So instead of going for the maximum annual contribution, you could instead aim to spread the government’s match over those 17 years. That means you could lower your monthly contribution to $146 a month ($1,750 a year) still get the full $7,200 the government pitches in while saving $750 every year compared to option A.

This is a great option for families who are operating with a budget that leaves very little wiggle room. However, over 18 years of contributions, that difference of $750 a year does add up to the tune of an extra $22,888. In other words, if you are able to manage the higher monthly contributions, it will be well worth your investment.

Whether $2,500 or $1,750, you now have a number to work towards every year so you can get the most out of the federal government’s contributions to your child’s education.

When should you start RESP contributions?

The biggest advantage of RESPs is compounding interest and the true power of compounding interest is time. That’s why it’s worth it to start as early as you can.

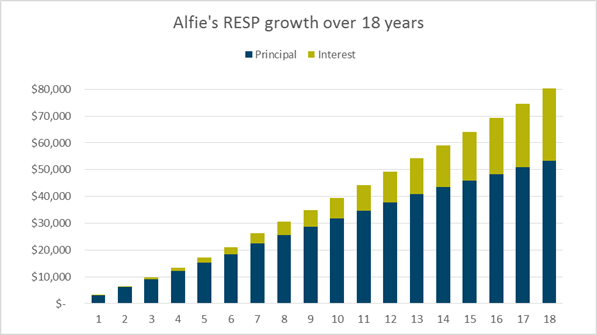

Example 1: compounding interest over a time period of 18 years

Let’s say you started saving for your son Alfie when he was born. So every year, you put $2,500 into your son’s RESP account until, after 18 years, you’ve contributed a total of $45,000. Assuming a 4% rate of return, you will have accumulated $80,231.18, of which $26,831.18 is in compounded interest earnings.

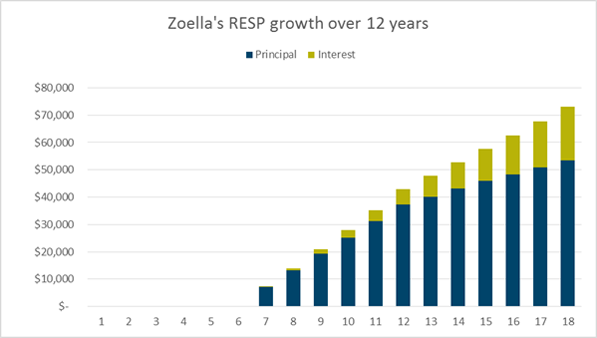

Example 2: compounding interest over 12 years

On the other hand, let’s say you only started saving for your daughter Zoella when she turned 6 but your goal was again to contribute $45,000 by the time she turns 18.

In the first six years, you can contribute $5,000 and qualify for the CESG entitlement carry-forward: so instead of the regular $500 maximum annual contribution, you would get $1,000. Then over the following six years, you would contribute the remaining $25K. At the same rate of return (4%), when Zoella turns 18, she will have $73,013.19 set aside for her education, or $19,613.19 in projected earnings.

Compounding a little is better than none

The difference ($7,217) between Alfie and Zoella is significant (hashtag compounding interest…) However, it’s important that you don’t kick yourself for not having opened an account six (or twelve or whatever it may be) years ago. The earliest you can start is today. Having interest compound over six years is less than over eighteen years, but it’s a lot more than none. Whatever you do is worth it.

Both Alfie and Zoella will be extremely grateful when they’re 30 and not struggling to pay off their student loans and you’ll have given them one of the greatest gifts you could give your children as they start down the path of adulthood:

A life not burdened by debt.

Are RESPs worth it?

What we’ve illustrated in this article are practical possibilities of how you could get the most out of your RESP.

In the case where you contribute $2,500 every year from the year your child is born until they turn 18 (totaling $45,000), adding the federal and provincial grants and a rate of 4%, you could get over $35,000 in return. That’s the power of an RESP.

In the end, your contributions to your child’s education need to fit within your larger financial picture. With every piece of the budget pie begging for your attention, it’s not easy to know what to focus on: getting rid of debt, paying off your mortgage, saving up for your child’s education.

The best thing you can do is to speak to one of our financial advisors and we can help you plot your way to your goals.

Simplifying your financial life so you can thrive, that’s what we’re about.